Resources

Using Equity to Build Wealth: The Basics Sydney Homeowners Should Know

Sydney’s median house price is now $1.46 million (CoreLogic, 2025), and if you own a home, you could be sitting on untapped equity, a powerful lever for building long-term wealth. Whether you're thinking about an investment property, upsizing, or setting your family up for the future, understanding how to use equity strategically is a game-changer.

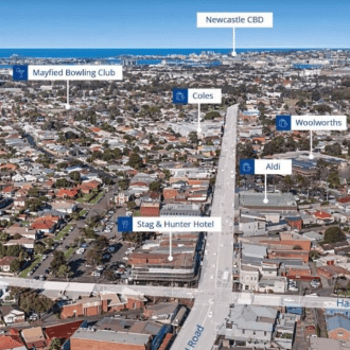

Let’s break down how it works, what to watch for, and how to use your Sydney property to invest in emerging markets like Newcastle.

What Is Equity?

Equity is the difference between your property's current market value and the balance remaining on your mortgage.

For example:

- Property value: $1,300,000

- Mortgage: $850,000

- Equity: $450,000

However, not all of that is usable. Most lenders let you borrow up to 80% of your home’s value without paying Lenders Mortgage Insurance (LMI).

Usable Equity: ~$190,000 ($1.3M x 80% = $1.04M – $850K)

If you’ve previously paid LMI or have exceptional serviceability, some lenders may let you go higher. The key is to speak with your broker or bank about your options.

Sydney’s 27.7% price growth since the pandemic (CoreLogic) means many homeowners now have significantly more equity than they realise.

How to Unlock Equity

You don’t need to sell to access your equity. There are several ways to unlock it:

1. Refinancing

Switch your mortgage to another lender or product and release equity as a cash-out component. Ideal if your current loan rate or structure no longer suits your needs.

2. Home Equity Loan

A separate loan secured against your home. Useful for a lump sum need, like a deposit on another property.

Pro Tip: Align early with your broker, accountant, and a buyer’s agent to ensure the move is both viable and strategic. What looks good on paper might not align with your long-term goals.

Risks and Rewards of Using Equity

Equity can supercharge your wealth-building strategy, but it comes with risks if not used wisely.

The Rewards:

- Accelerated Growth: Fund investments in high-growth regions like Newcastle.

- Flexibility: Upsize your family home or diversify your portfolio.

- Tax Benefits: Investment property expenses are often tax-deductible (ATO).

The Risks:

- Negative Equity: If property values fall, your equity may disappear. In 2018, 10% of mortgage holders faced this (RBA).

- Higher Repayments: If interest rates rise (even modestly), your new loan could strain your cash flow.

- Poor Investment Choices: Buying without research can erode returns.

With the right guidance, the upside can outweigh the downside. But equity should never be treated as "free money."

How I Help as a Buyer’s Agent

This isn’t just about what you can do with your equity, it’s about what makes sense for your goals. You need to:

- Calculate Usable Equity accurately, in collaboration with your mortgage broker or lender.

- Stress-Test Your Plan against rate rises, unexpected vacancies, or lifestyle changes.

- Match Strategy to Life Stage, whether you're upsizing, investing, or looking to semi-retire early.

Imagine drawing equity faster to invest in a cheaper market like Newcastle, have an extra property to secure your future, whether it becomes a nest egg for your kids' studies, a first home deposit gift, or a fully renovated beachside home you move into in 10, 15, or 20 years. It's all about what matters to you.

Case Study: From Marrickville to Newcastle

Meet Emma and James (name changed for privacy), a young couple in Marrickville. With a toddler and big dreams of growing their wealth, they didn’t want to wait 6+ years to save for a second Sydney property.

Instead, they tapped into $250K of usable equity from their $1.6M home, without selling. With that, they secured an $850K house in Newcastle: land component, strong local growth, and positive cashflow from day one.

How? A strategic $40K renovation added an extra bedroom (by making the most of a poor layout) and refreshed the property, boosting rental yield and long-term value.

By choosing a regional city with infrastructure growth, strong rental demand, and a lower entry point, they’re building their portfolio faster and smarter, while keeping their lifestyle base in Sydney.

3 Smart Ways to Use Your Equity

1. Upsizing Without Selling

If your family’s grown or you want more space, equity can help you upsize without selling your current home. In some cases, you can even retain it as an investment.

2. Rentvesting

Live where you love, invest where it makes sense (financially). Use your equity to buy in affordable growth corridors (like Newcastle, Central Coast, or SE QLD) while renting in Sydney.

3. Portfolio Building

Create a multi-property strategy by using existing equity as a springboard. The earlier you start, the more compounding works in your favour.

What NOT to Do With Your Equity

- Don’t Overleverage: Stay within safe loan-to-value ratios.

- Don’t Chase Hot Markets Blindly: Always buy based on data, not hype.

- Don’t DIY Complex Decisions: Equity use affects tax, borrowing capacity, and long-term planning. Get advice (accountant, broker, lender, tax agent).

Ready to Use Your Equity?

Equity isn’t just a number, it’s a powerful tool when used with strategy. Don’t let it sit idle while the market moves. Whether you’re investing in Newcastle, upsizing in Sydney, or planning ahead, now’s the time to act.

Disclaimer: This content is general information and not personal financial advice. Consult a licensed financial advisor, accountant or property professional for tailored guidance.

Article FAQs

You might also be interested in

Buying a Home Is a Business Decision - Even If You Plan to Live In It

Home buying is emotional, but your property is also your greatest investment. A strategic suburb choice, value‑adding improvements and equity manufacturing like renovations or granny flats can turn a home into a growth engine, adding up to $380K in equity over seven years. Learn how to blend lifestyle and strategy for lasting returns.

Kotara Suburb Profile

Imagine swapping big‑city prices for village perks: Kotara saw 6.09% house growth last year, with a $957,500 median sale price and 3.84–4.32% yields. Anchored by Westfield Kotara and leafy streets, this west‑of‑CBD suburb offers solid fundamentals, strong transport links and upcoming retail expansion, making it a strategic Newcastle investment.

Mayfield Suburb Profile

Imagine unlocking strong returns in a heritage suburb with cafes, festivals and green escapes under $1 million. Mayfield delivers 10.48% year‑on‑year growth, 4.38% unit yields and major precinct upgrades. Discover why this creative, affordable neighbourhood northwest of Newcastle CBD is a smart buy for investors and home‑buyers seeking both lifestyle and capital gains.